The Velocity of Time: An Exhaustive Analysis of Release Frequency, SKU Proliferation, and Market Saturation in the Global Watch Industry

Disclaimer

The following research was conducted by @MidlifeCrisisWatches using a series of prompts in Google’s Gemini. The data and insights presented here may not be fully accurate, so please read with a healthy dose of skepticism.

Why I Did This

I started this research because the sheer volume of watch releases lately feels overwhelming. As a consumer, I’m excited by new drops—but also hesitant to buy, knowing another big release is coming next week. The FOMO backlash is real.

So, I decided to dig deeper. The findings below help validate that feeling and uncover even more context around what’s happening in the market.

Contact

You can ping me at @MidlifeCrisisWatches on Instagram.

Executive Summary

Link to full article.

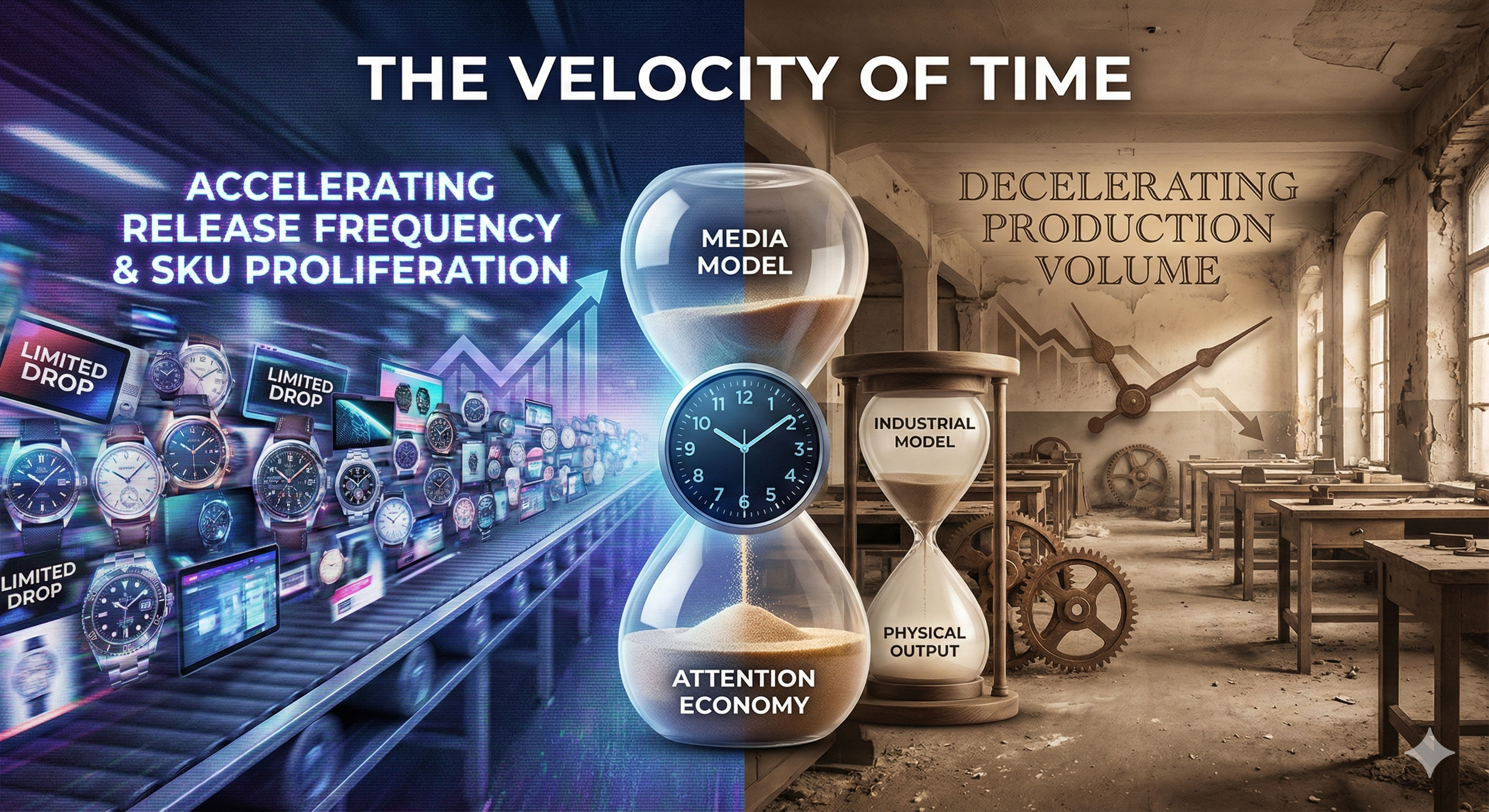

The global horological marketplace is currently characterized by a profound cognitive dissonance. To the consumer, the collector, and the casual observer, the industry appears to be in a state of hyper-acceleration, defined by a relentless barrage of new product launches, limited editions, and collaborative drops. The prevailing sentiment, as articulated in the query, suggests that "there are more new releases now than ever before." However, a rigorous analysis of industrial output data reveals a contradictory reality: the aggregate production volume of the Swiss watch industry-the benchmark for the luxury sector-has contracted significantly over the last two decades, reaching historic lows in 2024.

This report reconciles this paradox by deconstructing the structural shifts within the industry. We posit that while manufacturing volume has collapsed due to the obsolescence of entry-level segments, commercial velocity-measured by the frequency of marketing events, the number of distinct Stock Keeping Units (SKUs), and the fragmentation of the release calendar-has exploded. The industry has transitioned from a volume-based industrial model to a value-based media model. This transition is driven by the necessity to generate continuous digital engagement in an attention economy, the rise of the "drop culture" marketing mechanism, the democratization of manufacturing via microbrands, and the strategic proliferation of cosmetic variance over mechanical innovation.

The following analysis provides a comprehensive examination of these dynamics, supported by export statistics, financial reports, catalog data, and market trends. It explores the decoupling of volume and value, the specific release strategies of major conglomerates versus independent houses, the impact of the secondary market's formalization, and the "noise" generated by the digital media ecosystem.

1. The Macro-Economic Reality: The Great Decoupling of Volume and Value

To understand the current state of watch releases, one must first establish the industrial baseline. The perception of a flooding market stands in stark contrast to the manufacturing reality. The Swiss watch industry, which accounts for the vast majority of the luxury market's value, is shrinking in physical terms while expanding in financial terms. This phenomenon, known as "premiumization," is the foundational economic driver behind the perceived increase in releases.

1.1. The Collapse of Export Volumes (2000–2024)

Historically, the Swiss watch industry operated on a model that balanced high-volume entry-level production with low-volume prestige manufacturing. In the early 2000s, the industry routinely exported nearly 30 million timepieces annually. However, recent data from the Federation of the Swiss Watch Industry (FHS) paints a picture of dramatic contraction. By 2024, the total number of items exported had declined to approximately 15.3 million units, a fall of 9.4% compared to the previous year and a figure that represents roughly half of the volume exported at the turn of the millennium.1

This contraction is not a momentary dip but a structural realignment. The decline is most acute in the entry-level price segments, particularly quartz watches priced below 500 CHF. This segment has been decimated by the advent of the smartwatch and the shifting utility of the wristwatch. As noted in comparative analyses, the Apple Watch alone, since its debut in 2015, rapidly surpassed the entire Swiss industry in unit volume, selling 33 million units by 2017 against Switzerland's 24.3 million.3

However, while the factories are producing fewer objects, the financial turnover has surged. In 2023, Swiss watch exports reached a record value of 26.7 billion CHF, although 2024 saw a slight retraction to 24.8 billion CHF.1 This divergence—fewer watches sold for significantly more money—dictates the current release strategy.

1.2. The Economic Imperative of "Newness"

The collapse of volume creates a specific pressure on brands. When a company sells 30 million units, it can rely on the passive consumption of standard catalog items. When a company sells only 15 million units but targets a higher revenue target, it must extract more value from a smaller, more discerning client base. This shift forces brands to move from a strategy of customer acquisition (finding new people to buy a watch) to customer retention and reactivation (convincing the same collector to buy their fifth watch).

This economic reality is the primary engine of release frequency. To sell another watch to an existing client, the brand must offer something "new." It cannot be the same Speedmaster Professional that the client bought five years ago; it must be a "Snoopy Award" edition, a "Moonshine Gold" variant, or a heritage re-issue.6 The industry has replaced the production of commodities with the production of collectibles.

Consequently, the perception of "more releases" is accurate, but it is a measure of variance, not volume. Brands are slicing the same pie into thinner, more flavorful slices to tempt the appetite of the high-net-worth individual, creating an illusion of abundance in a market defined by industrial scarcity.

Continue reading the full 21 page document.